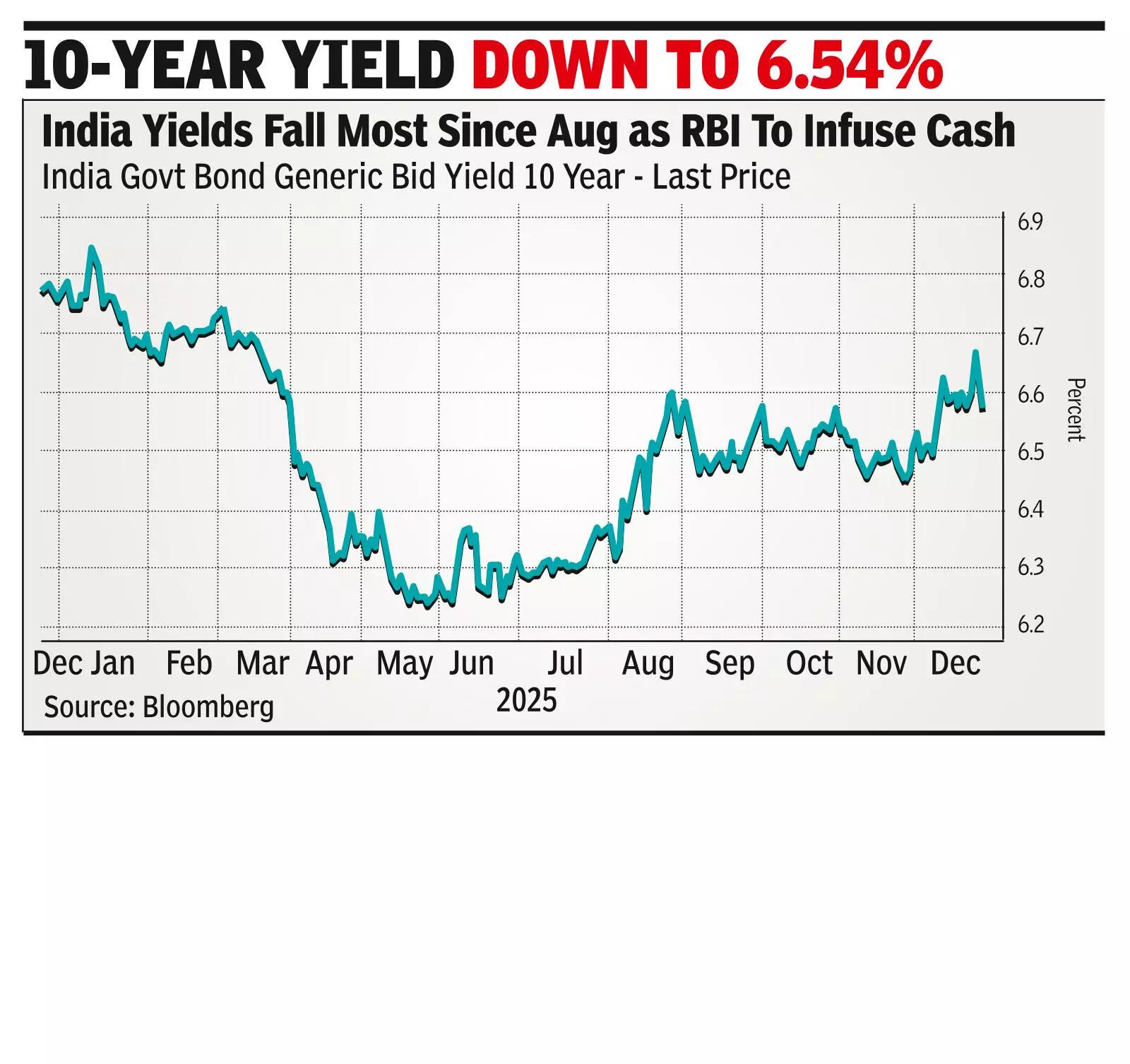

Government bond yields decline after RBI’s cash injection

MUMBAI: Government bonds rallied on Wednesday after RBI announced fresh liquidity measures to ease tight conditions, pulling the benchmark 10-year yield down to 6.54% from 6.63% on Tuesday, its biggest single-session fall since mid-May, as prices rose on expectations of durable liquidity support.

Bond dealers expect the yield on the 10-year bond to drop to 6.5% as liquidity situation in the market improves gradually.

RBI Slashes Rates After Rupee Fall, Boosts Liquidity And Lifts India’s GDP Forecast To 7.3%

The rally followed late-Tuesday measures announced by RBI to infuse around Rs 2.9 lakh crore into the banking system between Dec 29 and Jan 22 through Rs 2 lakh crore of open market bond purchases and a $10 billion, three-year dollar-rupee buy/sell swap.

RBI said it will buy Rs 2 lakh crore of bonds in four tranches over Dec and Jan and conduct the $10 billion FX swap next month.

On the announcement, the 10-year yield fell nine basis points, the most since early April.The planned infusion is double the liquidity injection announced earlier this month and is expected to offset the cash drain caused by RBI’s dollar sales to support the rupee, Asia’s worst-performing currency this year. The measures came after the benchmark yield climbed to a nine-month high earlier in the week amid concerns over tight liquidity and elevated debt supply.

“Despite the central bank’s announcement of USDINR swaps and Open Market Operations (OMO), the measures failed to ignite market enthusiasm as they did little to bridge the widening gap between dollar supply and demand ahead of year end,” said Dilip Parmar of HDFC Securities.“The injection across these two instruments of approximately Rs 2.9 lakh crore is more than we expected. Beyond the size, we see the timing as positive, as our conversations with market participants suggested expectations for RBI to announce new measures before year-end were limited; we and the market had been thought the bank would act closer to Feb,” said Nathan Sribalasundaram of Nomura Securities. He said that while system liquidity is likely to remain in surplus, MIBOR is unlikely to fall below the repo rate, as RBI retains the ability to withdraw short-term liquidity even as it injects durable funds. The steps add to RBI’s efforts to keep borrowing costs stable and support growth when lenders’ overnight borrowing costs have risen sharply due to tax outflows and FX intervention.